Distributors Take a Realistic Look at Business Conditions

By Matt Harding

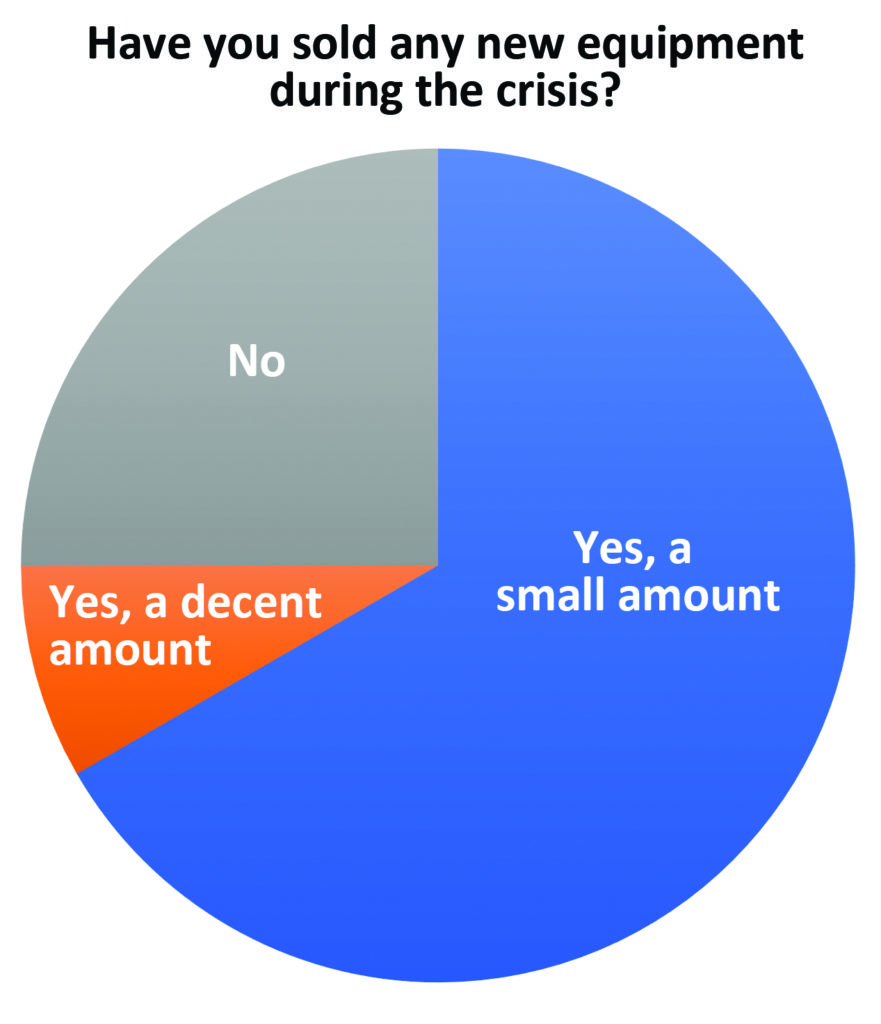

New games and other products are prepared to ship, but distributors are still expecting a slow recovery through this pandemic-caused economic recession, according to those who responded to our recent survey. With most businesses starting to at least partially reopen in May, June and July depending on location, distributors appear to be cautiously optimistic about how the industry will get through this period.

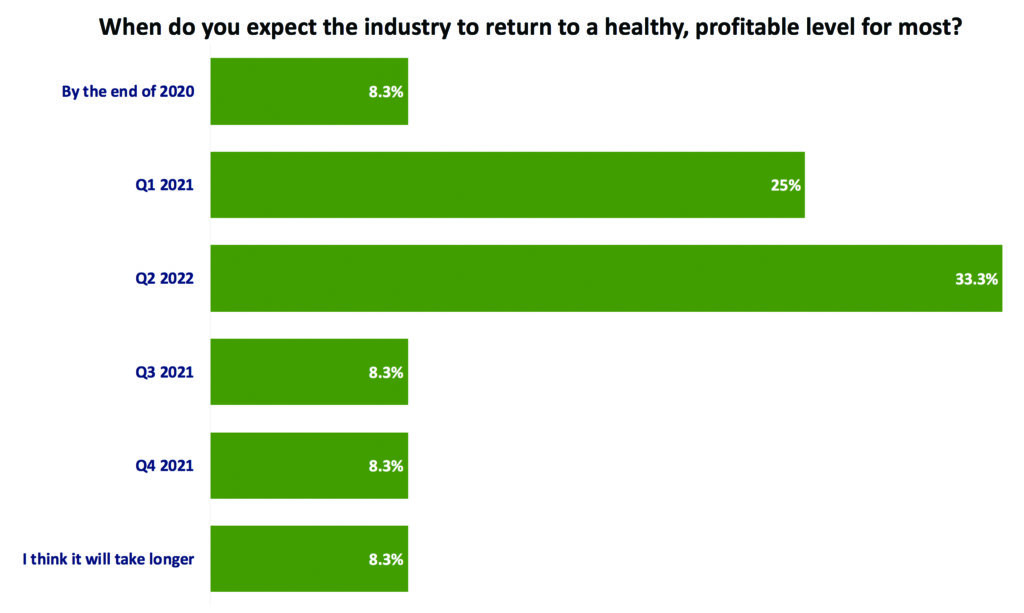

The majority of our distributor survey respondents – over 80% – expect the overall industry to return to a healthy, profitable level sometime during 2021. Of those, most anticipate a return during the first half of the year. More optimistic, 8.3% think it’ll happen by the end of this year, while the remaining 8.3% said it’ll take even longer than 2021.

Unlike some of their customers, the distributors themselves are almost entirely open for business; in fact, many of them never fully closed down. But since just about everyone else did, the majority reported at least slower than normal activity in their sales and service departments. Some said they shut those down completely for a while, so there was no activity at all.

To keep business going as “normal” as possible, many have turned to offering sanitizing supplies, signage and other COVID-19-related products. Others are simply weathering the storm, waiting for customers to fully open locations as guidelines around the country shift to allow for greater capacities – and hopefully – greater consumer spending.

Survey respondents, who could opt to remain anonymous, had a lot to say about how they’ve been coping financially, how they’ve been working with manufacturers, and what they’re hearing from their route operator and FEC customers.

Jon Brady, vice president of business development for Player One Amusement Group, was one of the few survey respondents who said they completely closed down during the shutdown. However, Brady reported Player One has been able to reopen at least partially in most of its locales.

Sales activity during the shutdown had been “almost nil,” Brady said, “except for a few pending orders that we couldn’t deliver in March or April.” There were also some consumer orders for pinball machines and home games.

He said he’s heard several reports from route operators who’ve been asked by locations to pick up equipment in restaurants and bars to make room for food and beverage service. Brady had also heard from FEC operators in early reopened states like Tennessee, South Carolina and Georgia that arcade revenues were between 25% and 50% of normal – potentially cause for optimism as most were only operating between those capacities due to initial social distancing guidelines.

“Manufacturers were all very supportive if we needed something,” Brady noted. “All are starting to reopen now, and are shipping in some capacity.” He added that he expects many location closures and guessed that “we won’t see a new normal until Q1 of 2022.”

Rich Babich, president of Game Exchange of Colorado, is a bit more optimistic on that end. He said he expects the industry to return by Q2 of 2021, qualifying that response with “or maybe longer.”

His company remained partially opened throughout the shutdown and was able to bring back all distribution employees by April 20. Before that, they were working with a skeleton crew, just to support essential services like ATMs and vending machines in hospitals and the like.

While business was “way slower than normal” during the shutdown, it continues to be slower than normal in the meantime, Babich reported. Lucky for Game Exchange, they’ve always used home sales and rentals to supplement revenue. “This segment of the business is up from a year ago, and a very solid piece of business,” Babich said, adding the retail portion of the business has been very good.

As for route operator customers of his, things aren’t looking too great in the near term. “As we speak, no game play is allowed yet in Colorado or New Mexico,” he noted. “Game play is allowed in Wyoming. Most operators tell us they will lose as much as 50% of their locations initially. We think they will get some of these back – probably ending with 20-25% fewer accounts.”

Despite that, Babich said, “I think we have gotten even closer to our customers and employees through this time. Most of us will get through this and be stronger when we come out the other end. I am truly surprised this is what disrupted our explosion of good business, but only a fool would have thought it would go on forever.”

Joe Camarota of Alpha-Omega Sales (also president of AAMA) anticipates the industry will return to a profitable level for most by Q2 2021. He, too, has seen glimmers of hope mixed among the stark reality of business in the COVID era.

“With the states that have reopened, revenues have been good,” he said, adding, “Several route operators have mentioned that they’ve been asked to remove their pool tables.” On the FEC side of things, Camarota mentioned that limited facility capacities have impacted things and some centers are closed permanently.

As for manufacturers, they’re “in a real quagmire,” he said. “With locations closed, there isn’t any equipment being built or sold and they don’t anticipate that changing until the end of this year due to the plethora of late model equipment that will be on the market due to facility closures.”

More than anything, Camarota has been impressed by the industry’s response to everything going on. “The collaborative spirit this industry maintains, once again, became very evident during this calamity. The desire to save our industry became the universal mantra, meaning so many people and companies sacrificed their own individual needs for the greater good.”

Marc Haim, president of Gold Coast International, isn’t seeing any silver linings, proclaiming: “I expect a much slower recovery and a year or two of reduced business in the leisure and amusement industries.”

He noted the company will offer a few sanitizing products for customers, and also increased efforts for home sales – though there was little traction on that. With slower than normal sales during the shutdown and a completely closed service department, which reopened May 26, Gold Coast was able to get a PPP loan to keep all of their employees. The staff all worked from home, while Haim coordinated everything from the office.

As operator business dried up, he also reported they were looking for financial help. “Many customers paid their small bills in full, but all the large debtors requested deferrals, or simply said they had no money. But I do expect that nearly all will pay in full once their businesses are reopened, given extended payment plans.”

Haim suspects route operators will lose locations as bars permanently close in the wake of coronavirus. “We will only see the full consequences of months with no revenues after the economy is fully opened again, and after the bar owners decide whether to remain in business,” he said. “I expect street operators to gradually lose locations during the rest of this year, but the surviving locations should return to normal revenues within a few months.”

Citing the airline, retail and car rental industries, Haim noted this is a very tenuous time to be in business, adding, “Survival means mind your expenses, keep debt manageable and assure efficient operations. We will continue to take care of our customers, our suppliers and our employees properly and fairly, and to be responsible participants in an industry that has served us so well for 74 years.”

Michael Dobel, president of Greater America Distributing, expects the industry to be back in tip-top shape “hopefully by the second half of next year.”

At the same time, he said, “I think we are going to see some manufacturers, distributors, operators and locations go broke. The full fallout will take a couple of years.” He added, “I am a true optimist, but silver linings are pretty hard to find.”

While his company was able to keep all employees thanks to a PPP loan and is fully open, sales have been “horrible” and business much slower than usual, as expected. They did some Facebook advertising and promotion for home sales, but that generated little success.

Dobel reported that route operator customers have shared that revenue was basically nothing for them during the shutdown, or at best about 20% of normal, and it’s still slow as the economy begins to open back up. He expects those problems to continue, predicting that 5 to 15% of locations will be closed permanently.

His biggest takeaway from the crisis: “Government has no understanding of our industry and we are the least of their concerns. We are at the bottom of the list.”

Tony Shamma, the VP of sales at AVS Companies, said that the company was fortunate to be able to secure a PPP loan and keep all employees on throughout the duration of the shutdown. While everything has been slower than normal, the company has worked to promote sanitizing supplies and other safety and cleaning COVID-related products for customers.

“Both FEC and route operators have had their struggles,” Shamma said, noting many FECs have permanently closed as a result of the shutdown. “Route operators have different struggles as a lot of their locations have either shut down or they are being told that they need to move some of their equipment out because they need space for social distancing. Our industry is being hit hard, and our customers will need our support to get past this tough time.”

As far as used equipment, Shamma said there will certainly be more than usually available, thus cutting into new equipment sales.

“I hope and pray that it recovers as quickly as possible,” he said. “Unfortunately, I believe it will be at least a year before we get back to where we were, and even then it may be a little tough.”

Optimistically, Shamma added: “When you’re passionate for the industry you love, you will do anything to make sure that it will survive and thrive. We have been through tough times in the past. With the support of all, we will come out of this better and stronger.”

Anonymous distributors also shared their thoughts, which mirrored others who said business is slow going but better than nothing. Overall, the range of distributors who responded to the RePlay survey was neither optimistic nor pessimistic – just realistic.

One distributor reported that some locations have closed permanently – affecting route and FEC operators. “Some area’s locations are not open yet and there are even some where our equipment is not being allowed to be used.”

The distributor added: “It is too early to tell the impact, but there will be a lot of used equipment soon. It will not only severely hurt suppliers and distributors, but it will also keep the quality of the entertainment products being displayed to the public at a less than perfect offering.”

As for industry outlook, they concluded, “We must change the way we operated, and the collective group must do the same. We can’t kill each other and work off extremely low margins and expect to win with reduced volumes and still offer the services our customers expect.”

Like others, multiple anonymous distributors responded that in their areas, a lot of bar and restaurant owners want equipment removed to make room for spreading out dining tables in the social distancing era. One added, “Also, a lot of requests for outside speakers connected to the jukebox. This is because locations created eating space on their parking lots.”

On a similar note, one distributor noted: “The bar and restaurant locations are being given guidelines that are confusing and in many cases contradictory.”

Another survey respondent has made the shift to sanitization, shipping hand sanitization stations to customers who prepare to reopen with new, more hygiene conscious options. They noted that COVID-19 has been a challenge for everyone to adjust to.

“I feel the industry has taken an unfair hit,” they said. “The longer the social distancing and the shutdowns go on, along with the statistical numbers and ways to acquire COVID-19 and other recommendations creating confusion and havoc, only makes things worse.

“There has been a lot of overreach and panic created that seems unjustified.”