According to a new study from RBR London, Global ATM Market and Forecasts to 2024, independent ATM operator growth has increased as banks abandon such services.

The report noted that the trend is worldwide and that banks are cutting back on their branch and ATM networks in response to continued growth of card and mobile payments, as well as declining foot traffic.

The results analyzed a wide range of ATM deployer types and their ATM location strategies. Historically, off-site ATMs have provided banks with a lower cost way of expanding their footprint, but even for these locations, banks are critically analyzing sites on a case-by-case basis and, in many cases, withdrawing.

As the RBR report noted, this has created opportunities for independent ATM deployers (IADs) operating with a lower cost deployment model. The new environment has not gone unnoticed by these operators, which have expanded their locations, taking advantage of the availability of sites following the removal or sale of bank ATMs. An example of this is in Ireland, where banks downsized their branch networks and new IADs have entered the market. In 2018 alone, the number of IAD terminals in Ireland grew by 72 percent, while the total number of ATMs installed in the country fell. This trend is mirrored elsewhere, including Brazil, Italy, Japan, South Korea and Spain.

“IADs continue to make gains in share in a wide range of markets around the world, and we expect this trend to continue,” said Rowan Berridge, who led the study. “Banks are increasingly cutting back their ATM deployment, with IADs often stepping in to fill the gaps left behind.”

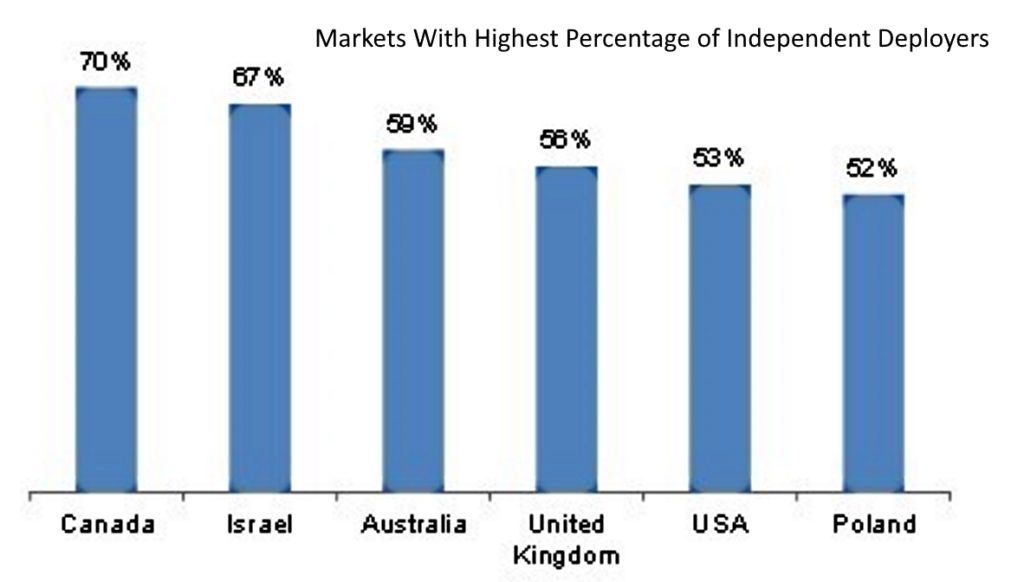

Over half of the world’s independent ATMs are found in North America – the largest proportion is found in Canada, where 70 percent of terminals are deployed by non-banks. The report also revealed that IADs account for the majority of ATMs in six markets – Australia, Canada, Israel, Poland, U.K. and the U.S. – with a presence in an additional 35 countries, representing two thirds of the largest markets covered in the study.

RBR forecasts that in most of the markets where independent ATMs are present, they will gain share over the next few years. In particular, the Netherlands, New Zealand, Ireland and Slovakia are projected to see significant rises in the share of these indie ATMs. Furthermore, the first IAD ATMs are expected to be deployed in Pakistan in 2019, following the central bank’s recent decision to allow such entities to operate in the country.

“This study confirms what we have long known, which is that entrepreneurial ATM deployers are able to provide higher quality service at lower cost to serve those communities that otherwise would not have access to financial services from traditional banks,” said Bruce Renard, executive director of the National AM Council. “There is a clear trend in the U.S. and worldwide where financial institutions outsource their ATM services, and I believe this trend to continue into the future.”

For additional information regarding RBR’s Global ATM Market and Forecasts to 2024, visit the firm’s website at:www.rbrlondon.com/consulting/