Maximizing Game Room Revenue

“How to Do It Right and Make More Money!” –– Part Two

Frank Seninsky

by Frank Seninsky, President/CEO Amusement Entertainment Management (AEM) & Alpha-Omega Amusements & Sales

[Editor’s note: In Part One, published in RePlay’s February 2016 issue, Frank covered “Cluster Theory,” “Dynamic Cluster Theory’s Additional Dimension,” “How to Direct Traffic in Your Facility – Use an Open, Free-Flor Floor Plan,” and “High Ceilings Are Your Friend.” For a first-time read or a refresher, that column is available online at: www.replaymag.com/current_issue/frank.html.]

In the hundreds of industry seminars that I have taught, and more than 1,500 articles I have penned over the past 47 years (on family entertainment center design, games and attractions layout, and operating and marketing lessons learned), clear direction (backed up by the reasons why) and actionable steps to be taken is always given freely on how to make more money. Yet, time and time again, I see FECs designed and operated in a random manner where little or no attention is paid to these simple truths. Ask yourself this question: “Do you really want to increase your game and total facility revenues and your bottom line profit as well?” If that’s a strong and loud “YES,” then keep reading and focus on following “the Crank’s Not for Fools Rules.”

What FEC Model Are You Creating?

This question is for both veteran operators and wannabees. When you’re looking down from above at your center concept and thinking about games, food and other attractions, you first have to decide what financial model you want to strive for. By that I mean, FEC models fall into well-defined financial categories:

Rule: Revenue category percentages of total revenue for an average size FEC (10,000 to less than 20,000 sq. ft.) closely approximates one-third attractions, one-third games and one-third food/beverage (usually no alcohol). You start with this model, and then during the first six months, you see in which direction you’re going to tweak, always asking, “Which of these revenue categories is going to make the most bottom-line profits?”

Depending on your market and the constantly unpredictable and changing economic conditions, you could grow all three, two of the three, just one, or even none at one particular time period.

Another option is to completely reshuffle the deck and change your focus. Reasons why you might change the focus are numerous. There could be a new attraction available that will draw an expanded demographic or increase visitation frequency. There might be a law or regulation change. You could either have a local competitor leave your marketplace, or a new local competitor comes to town. There might be a great cross-marketing opportunity with another business that emerges. It might be that interest rates increase or decrease, etc.

Maybe you want your food revenues stronger or maybe one of your partners is in the food business. Maybe you don’t know anything about food so you want a simple snack bar and want to limit your labor. (In that case, you’ll have more room for additional attractions and your revenue model becomes 40% attractions, 40% games, 20% food). Maybe a liquor license is available at a reasonable cost and you decide to go after the adult market with a Dave & Buster’s model (50% food/beverage, 50% games and 0% attractions).

The point here is that you’re eventually going to fit into one of those financial patterns. This is why my company AEM spends eight weeks analyzing each trade area market building linked spreadsheets of these different revenue models. The process includes costing out and projecting which percentage categories of the total revenue model will provide the highest return on investment (each category has a different cost of sales percentage and labor rate, among many differences) for a specific location in a particular market, and then looking at that model from every realistic angle to make sure it makes the most sense.

The revenue model and organizational structure must be a compatible fit for a particular owner or partner group, as well as their respective families and lifestyles. A final percentage ranking takes into account how each partner delegates responsibility, how they get along with the other partners, if their personal beliefs flow over to business practices, if they are charity- and community-minded, and on and on. It’s a lot more than “just numbers.”

Now Comes the Feasibility Study —Or Not

Much of the basic research up to this point can be accomplished by a knowledgeable business entrepreneur who has taken the time to go to industry trade shows, attend the many great educational programs, and travel to as many family entertainment centers as possible. Ah, but herein lies the problem. Wannabees tend to visit FECs on weekends and holidays because they have weekday jobs. They see large crowds of people and assume that the FEC is making money hand over fist. Almost all have never seen the actual financial statements of these terrific looking FECs. It’s possible that these “successful” FECs have huge debts or are paying too much in rent and are actually losing money.

In addition, there are many industry myths out there that cannot only deter you from generating additional revenues, but in some cases, can be the cause for the complete failure of your business. Here are three rules that might save you both time and money:

Rule: Every facility has to be right-sized for their current market. If there’s too much unused square footage, it looks to the general public like you’re about to go out of business. If the facility is built too small and there’s too many people trying to get in, then it goes back to what Yogi Berra once said: “Nobody goes to that restaurant anymore, it’s too crowded.”

That pretty much sums up why right-sizing is important. Many times it’s best to initially seal off part of the floor space and wait for the market to grow (if it’s determined that it is indeed going to grow). Better yet, lease out that space (short term, like three years) to a compatible business that will bring more customers to your door. When that lease is up, the space is ready for you.

Rule: Attend Foundations Entertainment University (www.foundationsuniversity.com) if you’re really serious about understanding the leisure out-of-home entertainment industry. You will learn in three days and two evenings of the hundreds of key ingredients it takes to create and operate a long-term, profitable entertainment center. You’ll have the opportunity to network with 20-30 other like-minded people, six well-known and highly respected industry consultants (with 150 years combined industry experience), and 15 top-rated suppliers. Most importantly, you will learn to look for and actually see the red flags as they pop up and know when it’s time to slow down, look deeper, and avoid the pitfalls that your competitors will surely not see.

Rule: Don’t waste your time writing your own business plan unless you just like to write. None of your financial data will tie in or be backed up. Guessing at utilization rates is like just writing in any revenue amount you choose. No one will take your biased projections seriously, especially the banking industry.

Now is the time to get serious and get bids for an independent, third-party feasibility study that can be flipped easily into a business plan. If you want to get funded (at a reasonable rate) and have a construction budget and square-foot list of every component space required, a feasibility study is a must, especially for any project with a budget in excess of $750,000.

Too often the hard-headed entrepreneur decides to skip the feasibility study because intuitively he/she knows the entertainment center will be successful because: “There is absolutely nothing for the kids to do around here.”

One would be surprised to learn all of the things around any small town that kids will find to do. Our competition is any leisure experience (not work-related) that a person or group can do that takes up two hours of their aggregate time daily both outside or inside of their home. This includes going to the movies, eating out, visiting a museum or a city park, feeding the ducks, playing cards or a family game, getting on Facebook, playing a computer game, going to the gym, watching football, etc. Our industry is lucky if we can obtain 1% of an individual’s leisure entertainment options.

Rule: It takes 80,000 customer visits at $12/visit to gross $1 million. Keep that in mind when you drink the cool aid and start believing that you can easily get those same 80,000 people to spend $20/visit because you have invested more money than anyone else ever has into an entertainment facility (or you have that special new unproven attraction) with local population of less than 250,000.

Rule: Almost every aspect of the family entertainment center industry is “counter-intuitive” — just the opposite of what the average person thinks. The more myths and falsehoods you think you know about this industry, the more dangerous you can be to yourself and your FEC business.

Myths and Falsehoods include: “You build it, they will come”; “Surely more than 3% of our customers will come more than four times per year”; “Lowering our prices during the week will bring in more business during the week”; “People will pay $8 for a game of laser tag”; “People will drive for more than 20 minutes to get to our facility if we advertise heavily to those places”; “People love to spend more money and get less value” (people also measure value in terms of “time”); “We can mark-up the prize points and reduce our cost of sales”; “We can price some of the new games at $2/play”; “We can upsell our birthday party packages to $35/child by just throwing in more attractions, food, game play and time, along with t-shirts and goodie bags.” (On this last one, you can get to the point where you make less –– or even lose money –– on your highest-priced party package vs. your lowest-priced party package).

Top Down Approach to Determining an Existing Facility’s Revenue Potential

(This also works for evaluating a potential new FEC space.)

When I enter an existing facility (I can also do this by phone with an owner who provides me with a current P&L and floor plan, while I’m also looking at the facility website), it’s not that difficult to determine what the maximum revenue potential should be under perfect conditions in any demographic market I’ve previously studied.

The way I do this is to prepare a 100-line list of “demerits” –– things that are not right about the facility layout, mix of attractions, position of games, mix of games, quality of food, birthday party and group packages, etc. For example, maybe the facility isn’t located in a good area, there’s too much competition, the rent is too high, the debt is too high or the marketing stinks. Maybe it isn’t possible to locate the games to the right of the main entrance; instead, maybe they have to go on the left. Maybe the food service has to go on the left side. Maybe the ceilings are too low.

I use this demerit checklist and give the location a starting score of $100 for its maximum potential revenue amount, and then subtract the negatives until I come to my “reality dollar number.” (I find this much easier to do than the “Bottom Up” approach of starting from $0 and adding revenues for each line item, and then using a factor to get to projected revenues.) That’s pretty much how a feasibility study projection spreadsheet is built once the revenue model has been determined and maximized — every which way. Obviously, this “Top Down Approach” has been learned through years of experience, but it works every time for me.

The Beauty of Perceived Value

To properly market your facility, you first have to choose your marketing hub and market from the inside out. By this I mean that your marketing graphic should look like the spokes of a bicycle wheel. The marketing hub –– the games, for example –– is at the center, and all of the marketing discount value packages are pointed out towards the rim of the wheel as the wheel goes round and round.

Now you have to look at the real value (your actual cost) vs. perceived value of everything you sell or redeem, making sure that the perceived value is anywhere from a low of 1.5 times the real value, to a high of 4 times. In fact, the whole concept of redemption is based on the customer’s perceived value of a ticket vs. your wholesale cost of the prizes that a redemption ticket represents. We buy everything at wholesale and our customers do not know that price is. All they know is what they’d pay for that item in a store. Knowing and understanding that huge difference, you want to choose the game room as the hub of your marketing efforts. This is because it’s there where you can almost give away so much stuff that has so little cost to you, but has a high perceived value to your customer.

That’s exactly what our industry attempts to do with birthday parties, but they often don’t take the time to closely evaluate each birthday party package to maximize the difference between the customer’s perceived value and the facility’s actual costs as the price of their party package options increase. Also, most facilities don’t go the extra mile to create several individual and small family and group discount value packages, and market them as such, using game tokens or e-credits to increase the perceived value of each package.

I create dozens of different “value discount packages” for our revenue-share and AEM clients to show how to properly upsell. When working with an amusement center, I go through competitive FECs’ websites and party packages, and compare those pricing upsells so my clients can gain an advantage. I provide a full analysis of their pricing, party package structuring and upsell techniques, putting it all on a spreadsheet so they can see what’s really happening. All too often, the result is that every time they upsell, they’re actually losing money. Because they never looked at it on a spreadsheet before, they had no idea this is what was happening.

Just because you’re selling a low-end party at $150 and you’re trying to get it to $300 doesn’t mean you’re going to make more money if you succeed. If you don’t do it right, you can make less money on the $300 party than on you did on the $150 package. This is because you are throwing too much into the package to make the upsell compelling without knowing how much those throw-ins are costing you. And not to mention your hidden costs or loss of additional revenue opportunity you are suffering because by upselling to a higher-priced and longer duration party, you are tying up your party space and your party staff when they could be getting ready and handling a new set of parties during that period. That is known as “throughput!”

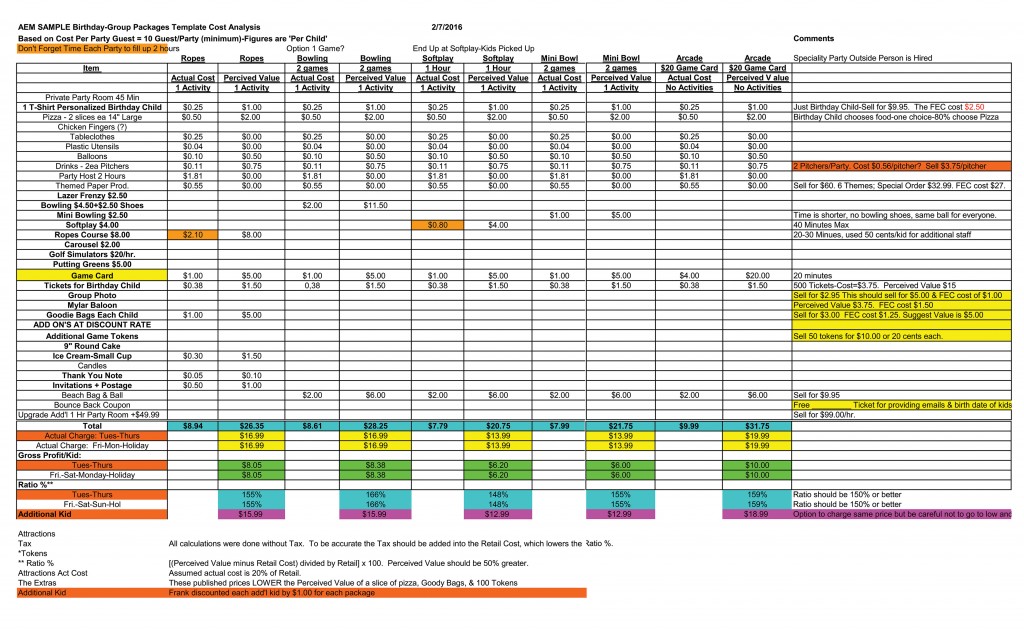

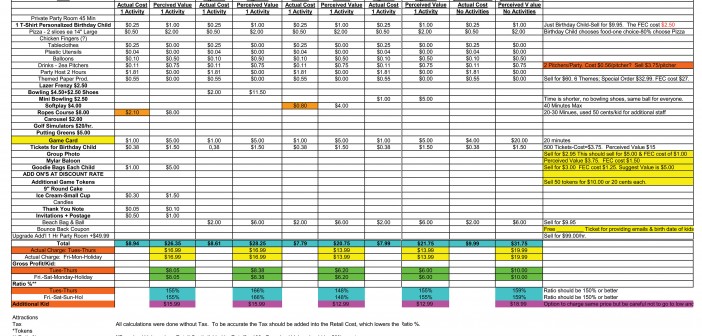

Spread-Sheeting Birthday Party Packages

Your party/group packages must be put into a spreadsheet that lists every line item attraction and product/labor cost side-by-side with one column being the actual price charged for each attraction, product, or service and your actual costs, and the other column being the customer’s perceived value of each line item. You will be very surprised at the differences.

For example, your party host may cost you $12/hour, but the Mom or Dad booking the party may put a value on that of $0 because a party host is expected, just like a waiter is expected in a restaurant. A parent places a 25 cent/play value on a game token (or e-play credit) and your actual cost for that token play (if you own your own games) is just the average cost of sales for the prizes won — in most cases 20% of the 25 cents or 5 cents. (The sample spreadsheet appears below; to download the image, click here.)

Frank Seninksy’s sample birthday party spreadsheet.

There is still a lot more to discuss about maximizing your game room revenue, so if enough of you give positive comments to Eddie and Key at RePlay, they may push me to do a Part Three and even a Part Four!

As always… keep cranking!

For more free information and to receive my “Top 10 Articles” over the past 47 years, sign up for my blog at frank-thecrank.com. (You can also sign up for my free Redemption & FEC Report by visiting the blog as well; www.AEMLLC.com and www.alphaomegasales.com also have a lot of free industry information and articles.) You can always contact me by emailing [email protected].

Frank Seninsky is President of the Alpha-Omega Group of companies, which includes a consulting agency, Amusement Entertainment Management (AEM), two nationwide revenue sharing equipment suppliers, Alpha-Omega Amusements, Inc. and Alpha-BET Entertainment, and Alpha-Omega Sales, a full line game and related equipment distributor. A frequent columnist and speaker, he’s set up over 600 game rooms in his 47-year career, and has also held leadership positions in the AMOA and IALEI. He’s a founding member of Foundations Entertainment University and authors The Redemption & FEC Report e-newsletter and a blog at www.frank-thecrank.com. Frank can be reached by phone at 732/254-3773 or by email at [email protected]

(the website: is www.AEMLLC.com).

2 Comments

Learning a ton from these neat artilces.

Pingback: Maximizing Game Room Revenue - Part 2