Cocooning Is the New Going Out

Consumer Habits Already Affecting the Future – Part Two

Randy White

By Randy White, CEO/White Hutchison Leisure & Learning Group

I’m now in my 29th year of working in the location-based entertainment (LBE) industry. Over those years I’ve seen many changes, but never happening as fast as now… and it’s only accelerating. The formula for success for LBEs is now far different than when I entered the industry or even just a few years ago. We are in disruptive times for LBEs. The competitive leisure landscape is very different today due to multiple external and cultural forces and trends. It’s time to rethink the LBE business model.

Here are some of major external forces at work which our company has identified and that require a new LBE success formula.

The Experience Economy

Joe Pine and James Gilmore first predicted the Experience Economy in their Harvard Business Review article back in 1998 followed by their book The Experience Economy a year later. Although it took a while to arrive, the Experience Economy is now here in full force.

Not that many years ago, if you wanted an out-of-home (OOH) experience, you went to a cultural or entertainment venue. Well, what people go out for has morphed into much more than that. It’s now all about going out for experiences of all types. And as a result, the competitive landscape for LBEs, whether entertainment-focused such as music and performance venues, theme parks, movie theaters, traditional FECs, laser tag and bowling centers or the new social dining-interactive entertainment facilities (“eatertainment”), has now greatly expanded.

LBEs now compete with every other option people have for OOH experiences. Now, every type of OOH business is becoming an experience. And when it comes to entertainment options, we even have retailers adding bowling, Ferris wheels, aquariums, restaurants and birthday parties to their stores to attract customers, often at no charge. The OOH experience competition has greatly expanded.

Digital Technology

Digital Technology

Digital technology is the most disruptive of all the changes with its endless options for entertainment and socialization. We can stream movies to our high-definition TVs in our homes. We can binge-watch shows on Netflix. We can hang out with our friends on social media or socialize face-to-face on videochatting apps. We can play massively multiplayer online video games.

We are also on the cusp of a boom in virtual reality that will offer experiences of all types on demand. When VR matures in the very near future with mass adoption, it will allow us to spend 3-dimensional immersive time with anyone at any location, real or imaginary, doing whatever we like for as long as we like while sitting on our couches at home. Steve Spielberg says, “Virtual reality will be a super drug.”

We also have fast-evolving augmented reality. Just look at how the crude Pokémon Go augmented reality app consumed so many people with its gamified entertainment, all at no or minimal cost.

Whereas in the past, LBE venues competed with each other, today they also compete with every form of digital entertainment and social option for our time and money. Leisure time is a zero sum game and the digital world is consuming a larger and larger share.

Today, people on average are spending 10 hours with digital technologies of all types (includes multitasking time). Digital technology is slowly taking slices out of the LBE market pie. Why leave home to visit an LBE when you can be entertained and socialize with your friends using digital technologies or when the entire world can be an entertainment playground with games such as Pokémon Go?

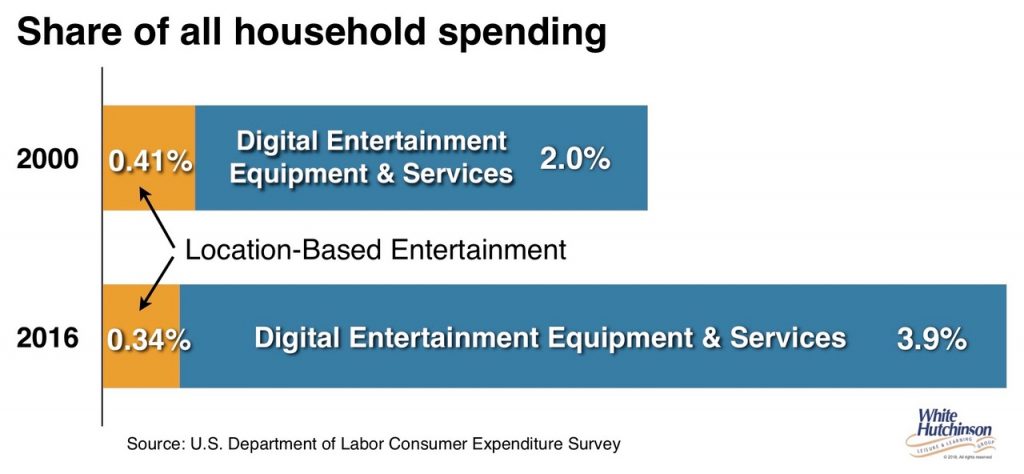

Not only their leisure time, but also more and more of peoples’ entertainment spending is also going to digital entertainment equipment and services. Since the year 2000, the digital share of all spending nearly doubled whereas the share going to LBE fees and admissions has declined by one-sixth. (See chart above.)

Not only their leisure time, but also more and more of peoples’ entertainment spending is also going to digital entertainment equipment and services. Since the year 2000, the digital share of all spending nearly doubled whereas the share going to LBE fees and admissions has declined by one-sixth. (See chart above.)

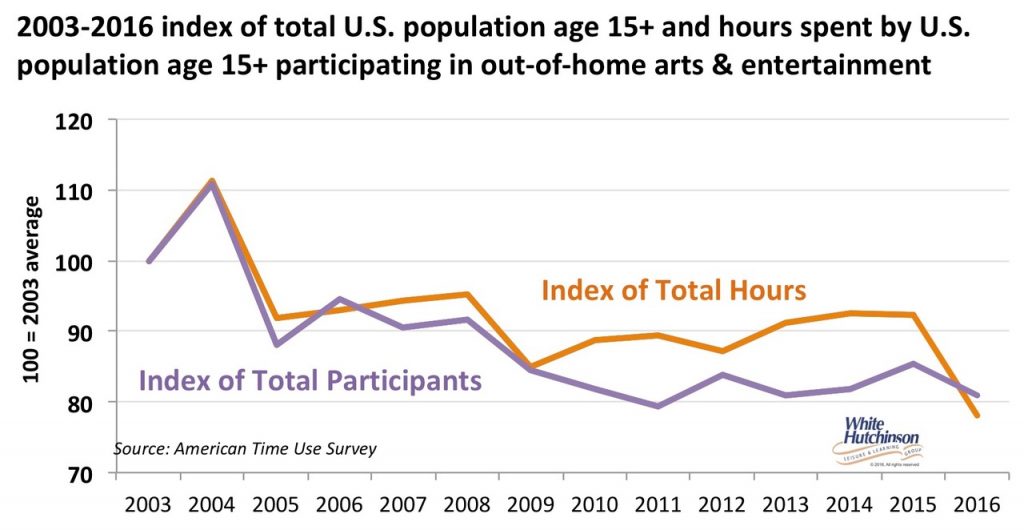

Our company’s extensive research also shows a trend of a continual decline in participation at LBE venues. Annual per capita moviegoing has declined by nearly one-third (31percent) since its peak in 2002 – from 4.9 times a year down to 3.4 last year. All other types of LBEs are also seeing declines, just not quite that severe, but still significant. (See chart .)

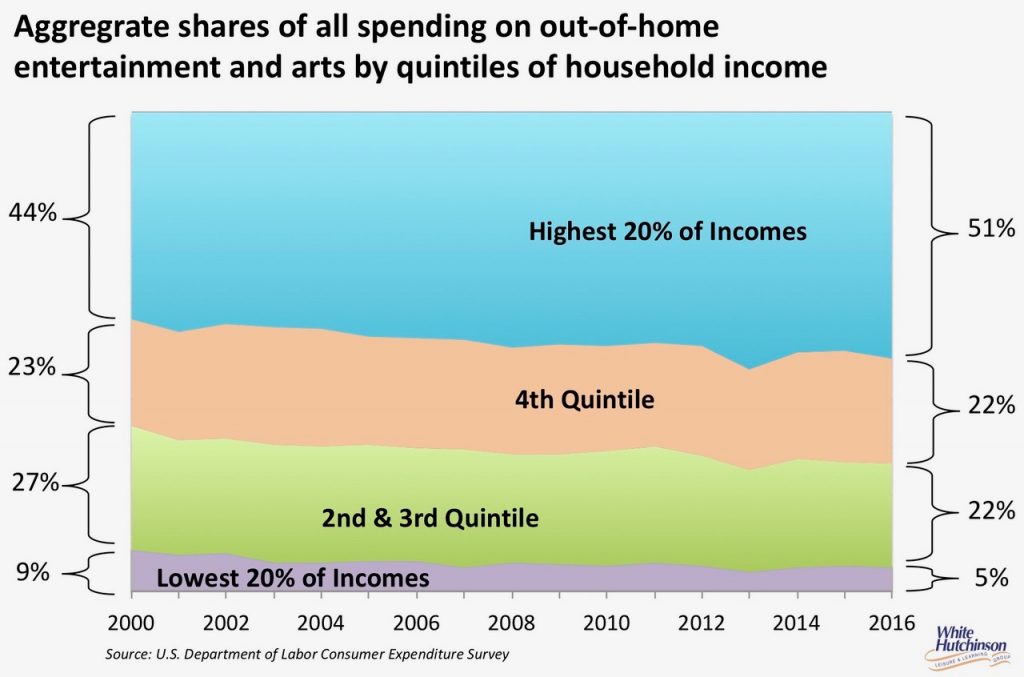

While the overall LBE attendance and revenue pie has shrunk, an increased proportion of the pie has shifted to higher socioeconomic consumers. Since 2000, OOH entertainment spending by the top 40 percent of income households has grown to account for nearly three-quarters (73 percent) of all such spending. For the higher income and college graduate households, their spending at OOH entertainment venues has increased while it has declined for the middle and lower income households. (See chart below.)

Experiential CVs

The Experience Economy combined with social media has also caused a shift in how we build our identities and social capital. Today people are interested in exploring and enjoying as many different experiences as possible. People collect different experiences to add to their “Experiential CVs” (Experiential Resumés). Their identities and social capital are now what they do, what they experience and share on social media and far less what they own.

Experiences are in; stuff is out. People are interested in unique and sharable experiences that they can add to the Experiential CVs. Why keep repeating the same entertainment experience at some LBE when there are so many other experiences that haven’t yet been discovered, enjoyed and shared and that can be added to their Experiential CVs? Repeat visitation, the bread and butter of many LBEs, has lost much of its appeal.

Dining Out

To add to all the OOH entertainment options people have today to choose from, add dining…yes, dining. Restaurants have always been around, but things have changed. Dining out has now elevated itself to an entertainment experience at many restaurants – one of discovery, adventure and sharing on social media. Chefs now need to not only be culinary experts, but also artists for sharable food photos. Over three-quarters (77 percent) of American adults now self-identify as foodies. A survey by Ypulse found that Millennials prefer going to restaurants over the movies, music venues, bars, concerts, and every other type of OOH entertainment venue.

Demographics

A number of long-term demographic trends are underway. They include:

• A declining number of births

• Families with children declining as a percentage of all households

• An increasing percentage of women who are remaining childless

• Putting off marriage until later years

• A shrinking middle class

• A growing upper-middle class

• An increasing singles population

• A declining young adult population

• An increasing older adult population

• An increasing percentage of college degree adults

Generation Homebody

Staying home rather than going out is a growing trend. This is driven not only by all our at-home digital options, but also by the growing appeal of the hygge movement – the pursuit and comfort of homespun pleasures. (See my article in RePlay’s November 2017 issue, posted online at www.replaymag.com/randy-white-guest-essay-november-2017). Now, in addition to retail ecommerce, we can have just about anything delivered to our homes on demand including groceries and meals from almost any restaurant.

One study found that more than two-thirds (69 percent) of the general population prefers staying home to going out, foregoing regular nights out for nights of watching TV, streaming media, playing old fashion board games and saving money for a big night out and special occasions.

Futurist Faith Popcorn says there is now a new lifestyle trend of people called “Bunkering,” which is seeking safety and escape from reality by retreating to the seclusion of their homes. Welcome to Generation Homebody.

Conscientious Consumer

A significant shift in consumer values has created a new consumer segment we call Conscientious Consumers. These represent a population larger than Millennials, larger than moms, and growing in size. They cross all ages, demographics and geographies.

Conscientious Consumers believe a company’s values, actions and corporate reputation are just as important as the products and services it offers. They practice what is often called “ethical consumerism,” the practice of purchasing products and services from companies that actively seek to minimize social and environmental damage and the avoidance of products and services that have a negative impact on society or the environment.

Conscientious Consumers are more loyal, less price-sensitive and more vocal than most Americans about the brands and companies they believe in and support.

Today, a large segment of consumers, including Conscientious Consumers, increasingly view corporate responsibility, from organic ingredients to animal welfare to company treatment of employees to sustainable practices as aspects of quality, not just a “feel-good factor.” They often consider purchasing products or services from an ethical company as a luxury and as a status symbol. For them, the idea of luxury is defined by a set of cultural values.

The vast majority of Conscientious Consumers belong to the highest educated Americans, mostly Millennials and Gen-Xers, including the ones with families with children. That group accounts for around 70 percent of all spending at LBEs.

Conscientious Consumers, who now link their wallets’ purchasing power, their use of leisure time and their word-of-mouth and eWOW to good citizen companies and their products and services, is today a significant consumer force. What it means is that just having great entertainment is no longer sufficient to succeed today. Acting socially and environmentally responsible and creating a positive social impact on society and the world is no longer optional for LBEs – it is now a basic requirement for success.

A New Business Model

Here are a few components of the new LBE business model our company is bringing to our clients with success.

The most successful LBEs now target higher socioeconomic adults, not the middle class and not families. The adult market is the largest and most profitable as you not only get the adults with their higher per capital spending, but you still get a lot of the families during the day and early evening.

Biologically, we have no need to bowl, ride go-karts or roller coasters, play laser tag, play in a gameroom or visit any other OOH entertainment venue. We do have a biological need to eat and drink, culturally a minimum of three times a day and for most people nowadays, additional times for snacking. So three or more times a day people have to make a choice of what and where to eat. And on average, five times a week, they choose to eat at a restaurant. The great advantage of food and beverages is it is easy to change and to create limited time offers (LTOs). LTOs are a proven concept to drive repeat business as they offer something new and unique to discover and share, driving repeat visits.

Food and drink drives more out-of-home visits then entertainment. People on average visit restaurants 73 times more often than they go to the movie theater, the most popular form of OOH entertainment.

However, it would not be accurate to suggest that food and beverages are more important than the entertainment or the overall experience offered. In reality, the true benefit of combining destination-worthy food and drink with entertainment is that the food and beverage offerings and the entertainment enhance each other.

Alone, neither may be enticing enough to compete strongly with peoples’ other leisure options. But combined? Great contemporary, quality food and drink, combined with classic entertainment, create a unique competitive positioning.

In addition to entertainment, food and drink, and being socially and environmentally responsible, the new business model requires two more essential elements. First, it has to be a great social environment and second, there has to be a high level of hospitality service.

The truth is that LBEs today need to recognize that they are no longer in the business of entertainment. They are in the hospitality business of offering guests an enjoyable social experience facilitated by food, drink, entertainment and a high level of guest service.

The bar to get people out of their home to visit an LBE is now incredibly high. Mediocrity no longer works. In fact, good is no longer an option. The experience now has to be premium, what we call High Fidelity. The value equation for how people spend their discretionary time and money has changed from just price, to “Is it worth my time, is it unique and shareable, am I doing business with a responsibly acting company and did I get my money’s worth?” People would rather spend their time on a premium experience that is more expensive than a mediocre experience at a lower price. When they decide to leave their homes, they want to spend their time and money wisely.

The future ain’t what it used to be. To prosper, location-based entertainment venues need to transform themselves into high-quality, ethical, social, eatertainment hospitality businesses where the entertainment is only one part of the business model and not necessarily the most important.

P.S. We need to thank Yogi Berra for the wisdom of “The future ain’t what it used to be.”

The White Hutchinson Leisure & Learning Group is a multi-disciplinary firm specializing in feasibility, concept and brand development, design and consulting for entertainment facilities. Over the past 26 years, the company has worked for over 500 clients in 32 countries, and won 16 first-place design awards. It publishes an occasional Leisure eNewsletter and Tweets (@whitehutchinson); Randy blogs. He is also a founder, co-regent and presenter at Foundations Entertainment University, now in its 13th year. Randy can be reached at 816/931-1040, ext. 100, or via the company’s website at www.white hutchinson.com. © 2015 White Hutchinson Leisure & Learning Group