Bowling Recovery

Business Looks Promising for Nation’s BECs

Howard McAuliffe

by Howard McAuliffe, Partner, Pinnacle Entertainment Group

The bowling business has been by far the biggest driver of new business for Pinnacle over the last 10 years. It has also most likely been the biggest driver of FEC equipment purchases in the U.S. over the last decade as well.

When we first went to Bowl Expo over 10 years ago, there was only one company from the FEC world exhibiting; this year there will likely be dozens. The bowling entertainment center or BEC has become a staple in many communities around the country. This growth period occurred during a period of low interest rates and a generally strong economy, and for many operators, a period with limited competition.

Prior to the Covid pandemic, competition was beginning to increase and then, this industry, which had been proliferating without experiencing a recession, was hit with a near total shutdown. The story of the Covid pandemic is one of extreme hardship, as well as resilience, for this very important driver of business for our industry. Fortunately, we have been using real data from our database to track the numbers which help illuminate what the bowling industry has gone through.

The Covid pandemic was starting to hit during the time the Amusement Expo was held in March 2020 and by June 1, only two of the 40 bowling centers we received data from were open. Most of our industry was in shock. There was little we could do except try to learn as much as possible about this virus and how to protect our families and businesses from it. Slowly but steadily over the summer, businesses began to reopen.

By August, most locations (outside of California) were open in some capacity and sales were 50% of the 2019 numbers. Main Event received an $80 million investment from Red Bird Capital, which likely kept them from bankruptcy, while Punch Bowl Social defaulted on their loans and was taken over by their lenders. The Main Event investment was the first indication for us that institutional investors were still interested in our industry, a welcome revelation as capital was certainly needed to make it through 2020.

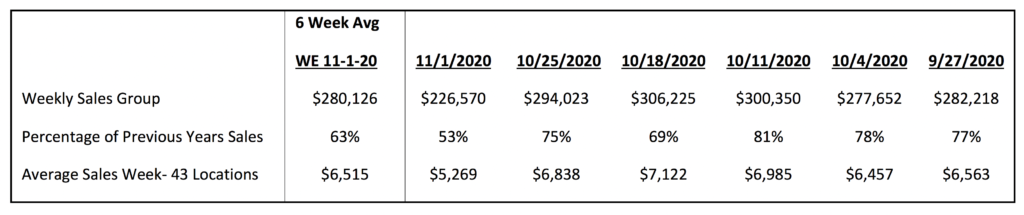

In the fall of 2020, we saw a steady increase in revenues as a percentage of 2019, as indicated in the table below. (Note: this table shows arcade sales based on all locations we track, of which about 70% include bowling.)

In the fall of 2020, we saw a steady increase in revenues as a percentage of 2019, as indicated in the table below. (Note: this table shows arcade sales based on all locations we track, of which about 70% include bowling.)

Just as we were starting to feel good about a recovery, sales began to falter in October, ultimately dropping in November as the Covid infection rate increased. This was devasting news for the bowling industry, where the vast majority of profits are usually realized between November and March.

The industry faced more location closures through the holidays, and even those who were open only had sales in the arcade of between 50 and 60% of 2019 levels, and near zero holiday corporate business.

Once again, we were worried about the survival of many of these businesses. There were some closures but most stayed open. We believe landlord and lender patience, as well as massive government aid kept most of the industry afloat. As the vaccination rate has increased through the early months of this year, and more federal stimulus boosted Americans’ bank accounts, so too have the sales. In March, our database showed sales figures returning to 95% of what we had in 2019 with all locations open to some degree outside of California. Many locations even saw sales above 2019 numbers.

In a study of location-based entertainment enterprise values produced by our friends at PJ Solomon, they showed values in our industry have actually increased since the pandemic started. (You can view the PJ Solomon study and our most recent detailed report at grouppinnacle.com/working-toward-a-new-normal-snapshot-of-recent-conditions). This is a strong indicator that our industry will have access to capital as we continue to rebound. Unfortunately, there will still be some struggles to overcome for the bowling entertainment center business.

Landlords and lenders were patient during 2020, but they really had no choice. There were no tenants to take space after an eviction, and little chance of getting paid back if they foreclosed on a loan. But now that profits are returning to the industry, many of these lenders and landlords want to be paid back, which will create a drag on profits. Furthermore, government stimulus cannot last forever, and the economy will eventually need to stand on its own. There will likely be some economic slowdown when the stimulus ends.

In addition, the current number one challenge in our industry is finding staff. It is still unclear why exactly there is such a shortage of workers. The consensus is that there are multiple factors at play, specifically: unemployment bonuses make staying home equal or better than low wage work, fear of the virus especially for teenage workers who can easily survive without working, and employees leaving the industry for warehouse work or other industries which pay better and are in demand.

I believe staffing will continue to be an issue even after the unemployment benefits go back to normal. Wages will need to increase in our industry to attract workers even if higher wages are not mandated by state or federal law. Walmart is raising their average pay to $15.25 an hour, pushing more part-time workers to full time, and offering benefits. So, why would an employee go to work at a bowling center for minimum wage or even $10 an hour when these kinds of opportunities are available?

While the aftershocks of this pandemic will likely be felt throughout the rest of 2021, I believe the worst is past and I’m looking forward to reconnecting with our bowling clients at Bowl Expo.

Bowling will continue to be an important part of the FEC business even though that will be in different ways than the previous 10 years. A significant portion of the BEC business has been driven by remodeling of older bowling centers, as well as building new bowling entertainment centers from the ground up. We will continue to see these types of facilities created but will also see bowling added to other types of facilities. Traditional FECs have started to add the anchor attraction to generate more winter and adult business.

We have also learned that arcades perform far better in movie theaters when bowling is an added attraction and as a result, many new theater projects will include bowling as that industry reinvents itself post-Covid. Bowling drives adult visits, arcade sales and food and beverage in a much larger variety of location types than I would have thought just a few years ago. Brunswick Bowling Products and other manufacturers have created smaller footprint bowling products that allow us to add bowling to smaller facilities and still provide all the benefits of the game. We have been adding these to many projects over the last few years, including two very successful facilities that opened during the pandemic.

It has been proven that FEC components, especially arcades, are a major benefit to bowling operators. Increasingly, we will see that bowling is likewise a major benefit to all operations that include FEC attractions. These two industries are inextricably linked for the foreseeable future and that is a very good thing for all of us.

Howard McAuliffe loves to imagine and implement new products, business models, and ideas, and is a partner in Pinnacle Entertainment Group Inc. He’s an industry veteran who got his start in the business when he was just 16 and has 20 years of expertise in product development, as well as FEC and route operations. Howard’s wife Reem and young son Sami are the center of life outside of work. When he’s not working, Howard can be found enjoying the outdoors, hiking, fishing and mountaineering. Traveling anywhere new or to old favorites like the American West is a passion. Readers can visit www.grouppinnacle.com for more information or contact Howard at [email protected], he welcomes positive as well as constructive feedback and counterpoints.