The Changing FEC Landscape

Demographics, Consumer Habits Already Affecting the Future – Part One

By Randy White, CEO/White Hutchison Leisure & Learning Group

There are a number of trends affecting the CLV (community leisure venue) business, including FECs, Bowling Entertainment Centers and other out-of-home entertainment locations, readers need to be aware of so they can plan position themselves for the future. Everything from consumer habits to shifting demographics are already impacting the earnings and growth potential of amusement locations and readers should be looking closely at their own operations in order to chart a course through the rapidly changing landscape.

Rising Expectations

Let’s start with consumer habits. We’re living in perhaps the most disruptive and dynamic period of human history. The pace of change is now faster than ever before and accelerating every day. One of the many disruptions, brought about partially by technology and the digital lifestyles we now live, is that the bar for consumer out-of-home experiences is being pushed higher and higher and higher every day. This is happening since overall consumer expectations are rising based on every experience they’re having.

Every time you get served well by Amazon, Starbucks, an on-line bank or Uber, your expectations of your next experience with any business increases.

It’s no longer good enough to be best in your industry –– consumers are comparing every experience to all experiences. Now every digital and real world experience is cultivating consumers’ mindsets with respect to all businesses they interact with. It’s no longer good enough to be the best community leisure venue (CLV) or FEC – you have to aspire to be great compared to all the experiences consumers have with all other businesses whether they are physical businesses or just digital interactions.

The problem that most CLVs and FECs have is that they don’t recognize they’re on the downward slope of these rising expectations. They think they’re keeping up, when, in fact, most are declining in the customers’ eyes. For most CLVs, especially the older model FECs, there is now a major gap between the experiences they offer and what guests expect.

Even if you design your business model around what people expect today, you need to revisit it. Why? Because people will expect something different in the future since that bar for experience expectations is continually rising. And the future is now arriving faster than ever before.

Screen Share Rises As Participation at Out-of-Home Leisure Venues Falls

There’s a commonly told parable that if you put a frog in a pot of room temperature water and slowly heat the water, the frog won’t perceive the danger and will be boiled alive.* That’s a great analogy to what is happening to many CLV operators, especially those operating the traditional FEC model. The leisure (or social and entertainment) competition landscape is changing, but they don’t sense the danger. So, many will become what we call “road kill.” Worse, many startup entrepreneurs are still following yesterday’s business model.

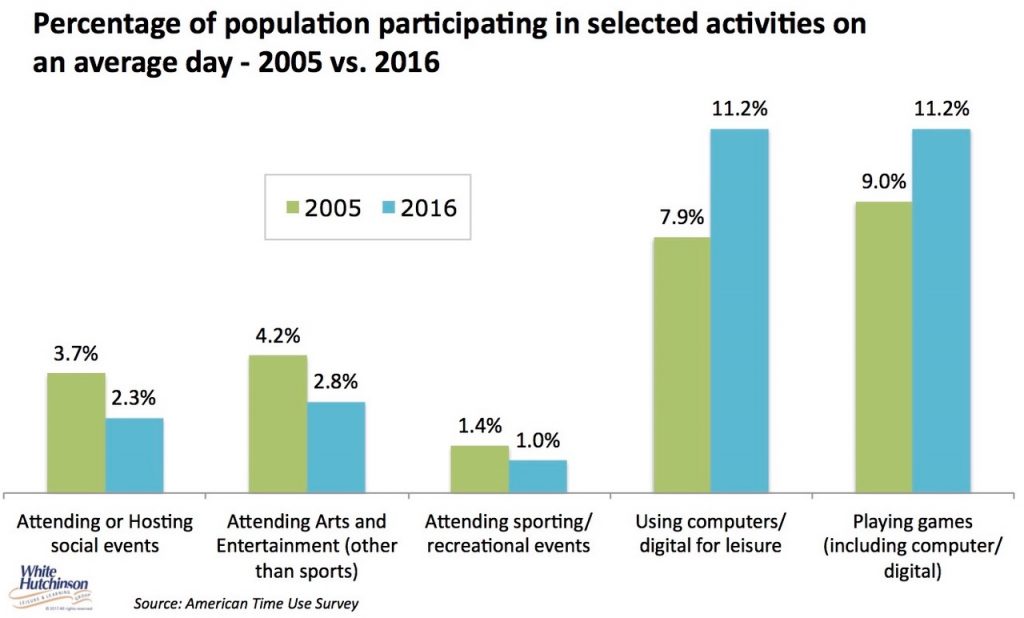

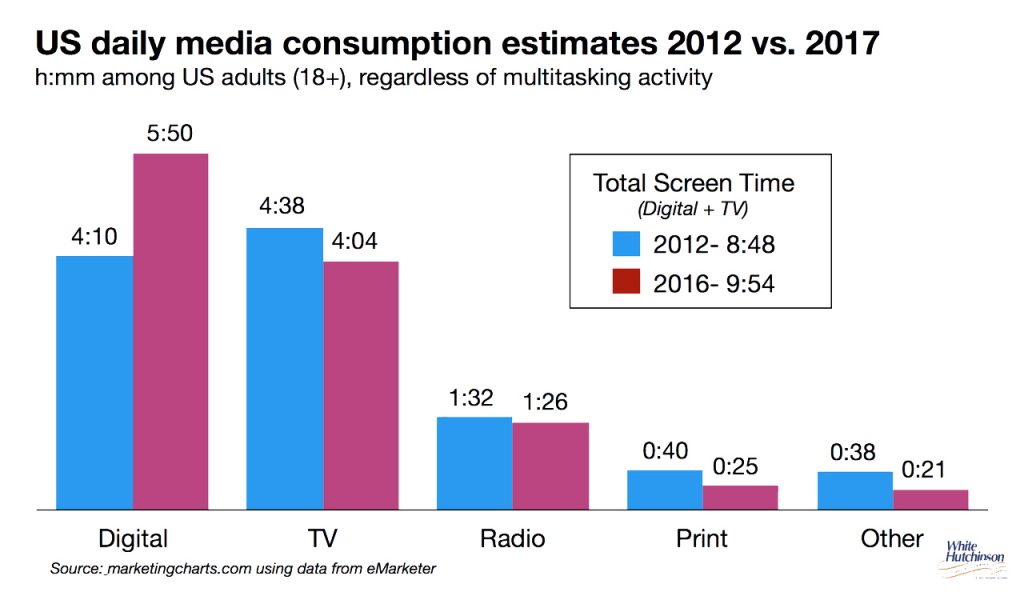

Increasingly today, more entertainment and socialization is taking place on the screen rather than at out-of-home locations. The leisure time people spend on their screens is continuing to increase and is displacing time spent at leisure venues. In just four years since 2012, average digital screen time has increased by more than one hour.

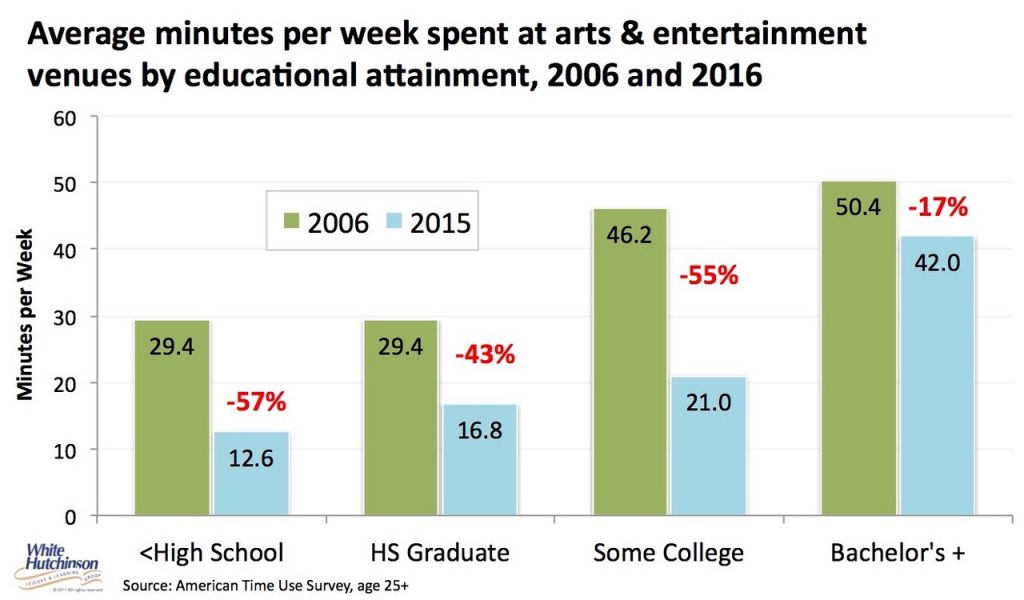

However, this change is not proportional across all socioeconomic groups. With the exception of basically the upper-middle class and higher socio-economic consumers (those with a Bachelor’s or higher college degrees), there has been roughly a one-half decline in participation (or time) spent at leisure venues. The decline for those in the college-degreed consumer demographic has been far less.

However, this change is not proportional across all socioeconomic groups. With the exception of basically the upper-middle class and higher socio-economic consumers (those with a Bachelor’s or higher college degrees), there has been roughly a one-half decline in participation (or time) spent at leisure venues. The decline for those in the college-degreed consumer demographic has been far less.

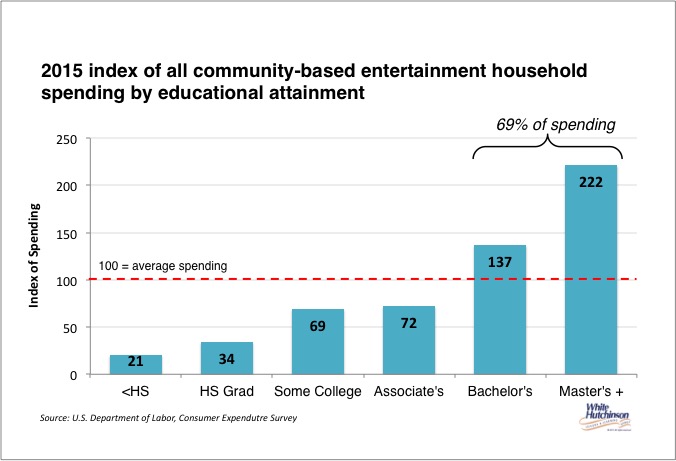

As a result, not only has the out-of-home leisure venue market shrunk, but a far greater share of the smaller market is now made up of higher socioeconomic consumers. In other words, the pie is smaller and a larger slice of that smaller pie is made up of consumers who make more money.

Today, households with a member who has a Bachelor’s or higher college degree account for 69% of all community-based entertainment spending.

Today, households with a member who has a Bachelor’s or higher college degree account for 69% of all community-based entertainment spending.

What does this mean for FECs and other entertainment venues?

• The middle class is no longer the market. The target market is now the upper-middle class, predominately the higher educated, more sophisticated, upper socioeconomic consumer.

• The market for out-of-home entertainment and socialization has dramatically shrunk and will probably continue to. Meanwhile, more and more location-based businesses are fighting for a share of that reduced-size market. To get the consumer out of their homes and away from their screens and to beat out the competition now requires a high quality/premium ––what we call “high fidelity” experience. Mediocrity or average, no longer works.

* In this age of alternate facts, we should note that the parable about the frog is not true. The frog will sense the approaching danger of the heating water and jump out of the pot before being cooked to death.

Positive Impact of More Young Adults at Home

Positive Impact of More Young Adults at Home

For many young adults today, graduating from childhood into adulthood seems to be an especially uncertain passage. The confluence of student loan debt, underemployment, and delayed marriage has resulted in a unique generational moment when more American young adults currently live with their parents than in any other living arrangement.

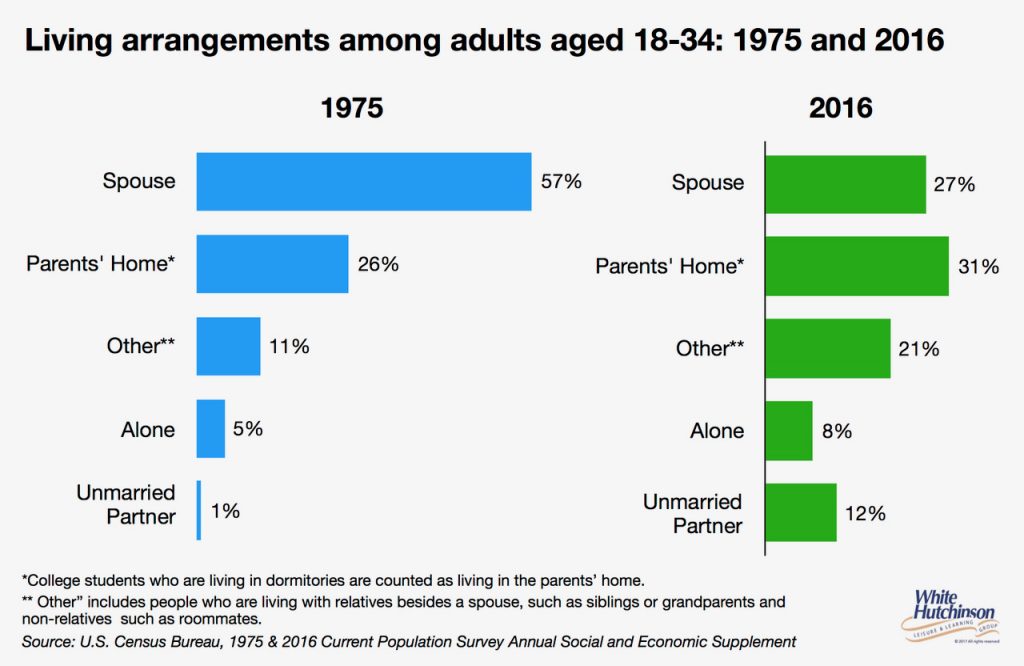

A new U.S. Census report revealed that about one third of Millennials (31%, or approximately 24 million young adults ages 18 to 34) still live with their parents. By comparison, 26% of young adults lived with their parents in 1975.

This has positive implications for CLVs that attract young adults. Adults living at home generally have more discretionary income to spend on entertainment and at restaurants than young adults living on their own or with a spouse or partner.

Demographic Shifts

Demographic Shifts

And finally for this month, here’s a look at some of the parallel demographic shifts underway in the U.S. that are disrupting the traditional family entertainment center (FEC) model.

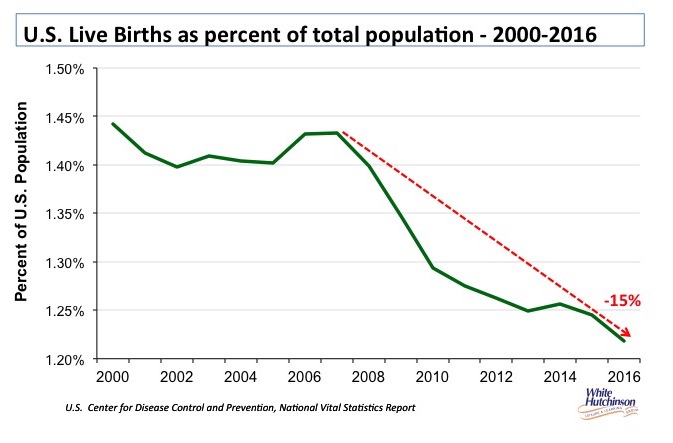

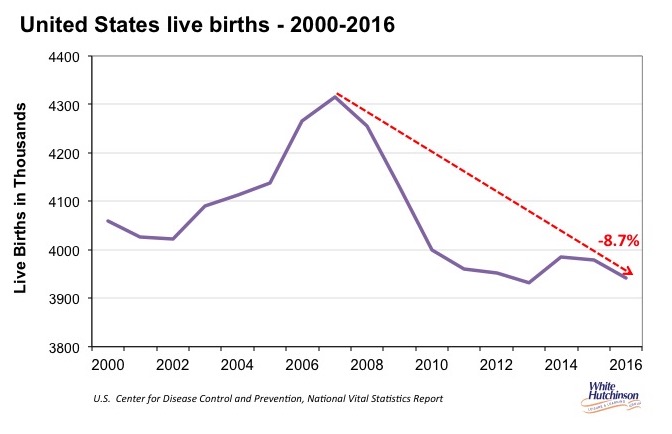

First is a continuing decline in the birthrate. The birthrate has been on a long-term decline since 2007. The fertility rate for women giving birth hit a historic all-time low in 2016. The number of babies born in 2016 was 1/12th less (-8.7%) than in 2007. More significant is that the number of births in 2016 compared to the total U.S. population was down by almost 1/6th (-15%) compared to 2007.

First is a continuing decline in the birthrate. The birthrate has been on a long-term decline since 2007. The fertility rate for women giving birth hit a historic all-time low in 2016. The number of babies born in 2016 was 1/12th less (-8.7%) than in 2007. More significant is that the number of births in 2016 compared to the total U.S. population was down by almost 1/6th (-15%) compared to 2007.

This means as the babies from 2008-2016 grow older, there will be less young children than in past years.

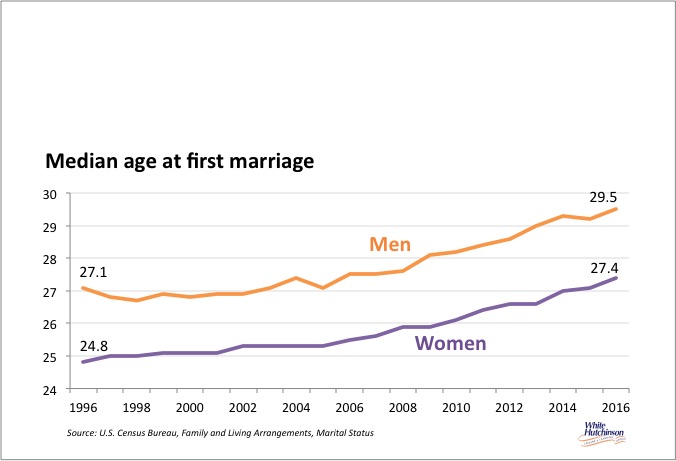

Here’s the most interesting thing about the 2016 birth statistics: For the first time, the birth rate for women aged 30 to 34 was higher than the rate for women aged 25 to 29. The 25-to-29 age group has held the distinction of being the peak childbearing years since 1983, when it overtook the 20-to-24 age group. Simply put: Women today are delaying having children.

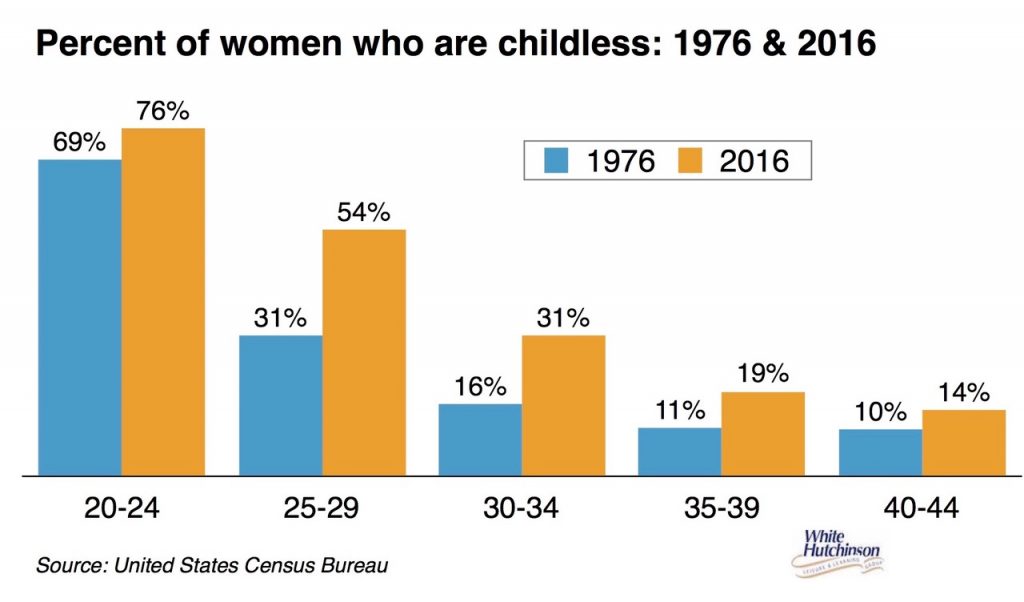

Simultaneously with this trend, we’re seeing a second trend of a growing number of childless women and couples.

Simultaneously with this trend, we’re seeing a second trend of a growing number of childless women and couples.

The third demographic shift is that the proportion of young adults who are single, a prime target demographic for a lot of social interactive entertainment, is growing due to more and more people putting off marriage until later years.

Implications

What this means for locations that target families with children, and particularly the traditional family entertainment center (FEC) model as well as for children’s entertainment venues, is that the market has shrunk and will continue to shrink into the future as the children born in 2008 and later grow older. Then on top of these demographic shifts, we have the growing disruption as the digital world competes and captures a growing share of family and children’s leisure time. Many markets that once could support a traditional FEC or children’s center will no longer be able to do so.

At the same time the family market is shrinking, the adult-oriented market is growing with more and more childless single women and childless couples, especially younger adults. As a result, the industry is at an inflection point where the majority of new and remodeled CLVs will be adult-oriented rather than family oriented.

Come gather ‘round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You’ll be drenched to the bone

If your time to you

Is worth savin’

Then you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’

–– “The Times They are A-Changin” by Bob Dylan

Next month, we’ll continue the discussion of trends affecting the future of the FEC business, specifically a consumer behavior that’s been labeled “Hygge” (a Danish word and trend that refers to “the constant pursuit of homespun pleasures”). What I’m talking about is “cocooning” and it’s having a direct impact today on how often people are going out to enjoy the amusement industry’s products and venues.

The White Hutchinson Leisure & Learning Group is a multi-disciplinary firm specializing in feasibility, concept and brand development, design and consulting for entertainment facilities. Over the past 26 years, the company has worked for over 500 clients in 32 countries, and won 16 first-place design awards. It publishes an occasional Leisure eNewsletter and Tweets (@whitehutchinson); Randy blogs. He is also a founder, co-regent and presenter at Foundations Entertainment University, now in its 13th year. Randy can be reached at 816/931-1040, ext. 100, or via the company’s website at www.white hutchinson.com. © 2015 White Hutchinson Leisure & Learning Group