With all the talk of cashless systems and new ways to pay, it helps to remember that cold, hard cash is still king. According to the 2016 U.S. Health of Cash Study by Cardtronics, a fractured payment landscape has led to individuals having multiple options to pay nearly anywhere, yet in brick-and-mortar stores and for small purchases, the customer keeps picking cash.

The study says 85 percent of consumers use at least two payment options regularly, whether that’s cash, card, digital or mobile. 56 percent of consumers are using cash as frequently as they were last year, and 23 percent are using it even more.

“Consumers today desire and demand more payment choices in their financial lives to make life easier on their terms,” said Jonathan Simpson-Dent, Chief Commercial Officer for Cardtronics. “While emerging digital and mobile payment technologies are on the rise, the pace of adoption is sensible. Cash continues to be commonly used at the point-of-sale and is the runaway choice for person-to-person (P2P) payments, with 79 percent of consumers overall – and 73 percent of millennials – preferring to pay back friends and family with cash over P2P payment apps.”

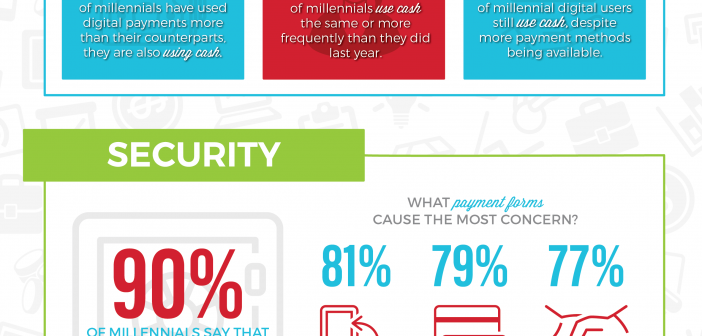

Payment apps like Venmo are growing in popularity and could bite into cash usage in P2P payments, but the study shows that is only just beginning, especially in the younger, more tech-savvy crowds. Millennials are utilizing every major payment method more frequently than the group was a year ago, except checks, and despite the growing options two-thirds still use cash regularly.

In specific situations such as “splitting a bill” at a restaurant, 55 percent of consumers prefer using cash while P2P apps are carving out a small (but growing) 10 percent chunk. Courtesy of Cardtronics.

Security concerns and budgeting continue to drive people toward the “traditional” paper and coin payment method, with a whopping 83 percent of consumers feeling concerned about data security and privacy and 93 percent believing cash is safe from hackers and other online threats. 84 percent of consumers say they always keep cash on hand, with an average of $50 in respondents’ wallets.

In conclusion, when you have 83 percent of respondents saying they would miss cash if it went away as a payment method, and 85 percent believing paper money will never go out of style, it’s definite that the new norm is no cashless society. To conduct the study, Cardtronics partnered with Edelman Intelligence, an independent market research company, surveying 1,006 people over 18 years of age.

For more information, click here and see the infographic below.